According to the 2023 Process Optimization Report by Celonis, a whopping 97% of finance and shared services professionals agree that process optimization is important or even essential to meet their business objectives.

Yet, almost half (44%) reported that their business-critical processes like accounts receivable and accounts payable are running in a sub-optimal way.

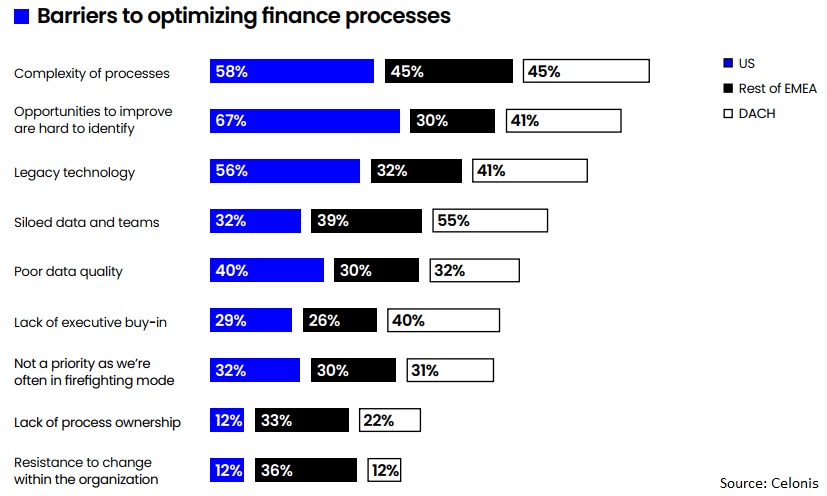

When probed further, they cited the following as the top 3 impediments for their process excellence initiatives:

- Complexity of processes

- Opportunities to improve are hard to identify

- Legacy technology

Not surprisingly, a mere 26% are currently using process mining tools to gain visibility into finance processes. For the uninitiated, process mining is a technology that discovers, monitors and improves actual processes by leveraging real-time and historical data for business processes and operations.

Some of the ways process mining can help include:

- Identifying and defining opportunities for improvement within a process

- Understanding how processes interact

- Orchestrating improvements across people, processes, and technologies

- Understanding how processes actually run

- Measuring how a process currently performs

- Analyzing how to optimize the process

#processmining #processdiscovery #processexcellence #operationalexcellence #continuousimprovements